With tax bills mailed out recently, we know that questions will arise. An effective way to understand the bill is to first compare it to last year’s bill. If you notice a discrepancy while comparing, it may be due to one or more of the following: The tax rates changed.

- There was a change in your total real value due to a permit issued, data correction, new construction, boundary line adjustment or subdivision, etc. If this was the case, you would have received a Change of Assessment Value letter this past June from the Assessing Department.

- The State of VT issued property tax credit, which is based on income, may have decreased due to the State’s income limit decreasing from last year. If you qualified for a property tax credit, you would have received a letter in June/July 2025 from the State of VT Department of Taxes indicating what the amount of credit will be.

- Check to see if the tax rate is based on homestead or non-homestead. These two rates are different. You must declare homestead annually if the property is your primary residence. The Homestead Declaration, titled Form HS-122, is filed with the State of VT Tax Department. Additionally, if you qualify for the property tax credit, Form is HI-144 is required. The Homestead Declaration form is typically filed at the same time income taxes are submitted to the state. Once the state has processed your taxes, they send your Homestead Declaration details to the Assessing Department. This information determines how your property's assessed value is allocated towards the homestead tax rate portion of your tax bill. If a Homestead Declaration is not filed, the entire assessed value is taxed at the non-homestead rate. If any portion of the property is used for rental or business purposes and declared on the Homestead Declaration, that specific percentage is categorized as non-homestead, and the remaining value is assessed at the homestead rate.

Please go to the Town of Essex website to the Assessing webpage Your Vermont Property Tax Bill | Department of Taxes for more information.

In addition, please visit the State of VT Tax Department website Homestead Declaration | Department of Taxes for more information on Homestead Declaration.

Before delving into more detail and clarification about tax bills and a reappraisal, I want to clarify and clear up what is a common misunderstanding regarding the Homestead Declaration Form, HS-122 (primary residence) and the Homestead Income Form, HS-144 (property tax credit).

One might think that if you do not qualify for the homestead property tax credit, then you do not have to declare homestead. This is incorrect. If you do not submit HS-122, then your tax bill will be based on the non-homestead tax rate, which is typically a higher tax rate than the homestead tax rate. The Form HS-122, required for submittal annually, by or on April 15th to the State of Vermont Tax Department, declares your primary residence. If the property owner qualifies, then Form HS-144, submitted along with HS-122, will provide the property owner with a property tax credit. There are income limits that the state’s tax department changes annually pertaining to the calculations for property tax credits. You can have the HS-122 without HS-144, but not vice versa.

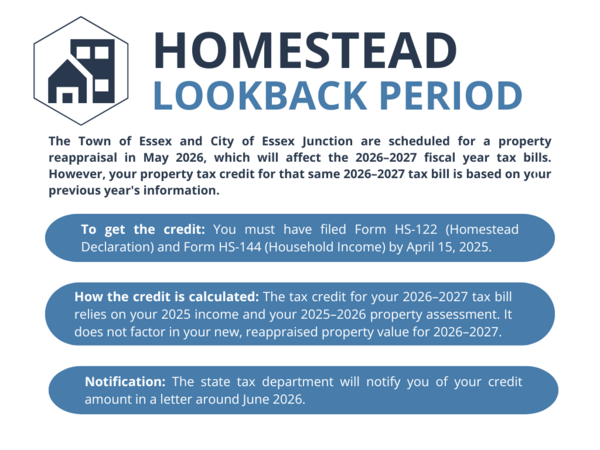

Now comes the more complicated portion of the tax bill regarding a reappraisal year and the property tax credit, if qualified.

During the upcoming reappraisal in the town and city (completed in May 2026), your property tax credit will not be calculated based on your new property valuation. The 2026–2027 tax year credit is based on your previous tax data and 2025 income. The full effect of the reappraisal on your tax credit will not be seen until the following tax year, 2027–2028. This is because the property tax credit system uses a "lookback" period for its calculations. A tax bill that is based on the homestead tax rate will have a box at the top right-hand corner. That box breaks down what the property owner paid for municipal house site tax and education house site tax for that fiscal year taxes. These figures are what determine a property owner’s property tax credit, if qualified, for the following year’s fiscal taxes.

Below are links to the state’s website with more information pertaining to the education tax rate calculations and frequently asked questions.

https://tax.vermont.gov/property/education-property-tax-rates/faqs

https://tax.vermont.gov/document/2025-property-tax-credit-calculator

(please note, this link is the 2025 calculator, the 2026 calculator will not be available until next year. This link is for informational purposes pertaining to how property tax credits are calculated each year).

If you have any questions, please do not hesitate to contact the Assessing Department at (802) 878-1345 or email assessor@essex.org.