Why is a Municipal-wide reappraisal necessary?

Over time, the market changes. This is due to supply and demand as it relates to various aspects of buyer and seller behaviors, location and building type. As a result, a location and/or building type may have become less or more valuable than it was in a previous reappraisal. A reappraisal identifies these market changes and appropriately assesses these variations to ensure fair and equitable valuations. In addition, the State of Vermont Property Valuation & Review Tax Department completes an annual equalization study of each community in the state. This study provides a Common Level of Appraisal (CLA) that indicates the ratio of sale prices over the past three years to the municipality’s Grand List assessed values. The current CLA for the Town of Essex & City of Essex Junction is 78.35%. A reappraisal is necessary to bring that ratio back to 100% market value.

Based on market trends, the current CLA, and most recent reappraisal conducted in 2007, it was decided that a municipal-wide reappraisal is warranted.

I have not done any improvements to my house; how can the value go up or down?

The market has changed since the last reappraisal in 2007. The purpose of the reappraisal is to bring the values established in 2007 to current market values and to ensure equity across all properties.

What if I am not at home when the data collectors visit my home?

Letters will be mailed in groups to property owners to inform them that the data collectors will be in their neighborhood. The letter explains the data collecting process during the reappraisal project (A sample of the letter is available on the Town of Essex website; www.essexvt.org > Assessing Department > Reappraisal 2025). Unfortunately, it is impossible to pinpoint the exact date and/or day that they will be at a certain property unless a prior appointment is scheduled. We do realize property owners have cameras to protect themselves and their property. The data collectors will be wearing identification badges and orange reflective vests to ensure their identification in person and/or on a video camera. They will knock 2x and if no one answers they leave a placard on the door explaining that they were there and to call for an interior inspection, but they also perform the exterior work at that time.

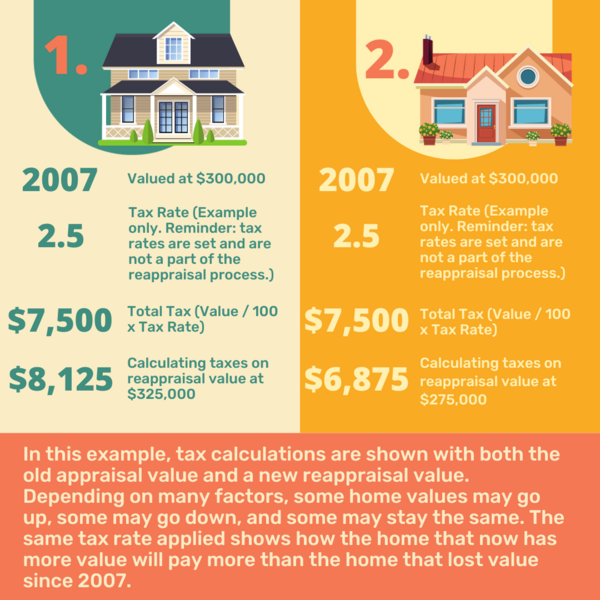

How will a reappraisal impact what I pay in property taxes?

Property taxes are based on property values. Without periodic reappraisals, some property owners would pay relatively more while others would pay relatively less. Reappraisal resets property values to their current market value so that the property tax burden is equalized for all taxpayers. Reappraisal assures every property owner they are only paying their fair share. However, appraisal and taxation are separate issues. The Assessor determines the market value, and the municipality and state tax rates have no impact on the valuation process. Each taxing authority establishes its own tax rate. Municipal tax rates are set based on the need to raise money for municipality highway and general fund expenses. The municipal rate is levied against the municipal grand list. The education tax rates are based on a homestead education tax rate and a non-homestead education tax rate which are set annually by the commissioner of taxes. The education tax rates are levied against all homestead and non-homestead parcels on the education grand list. Even if your assessment doubled that does not mean your taxes would double.