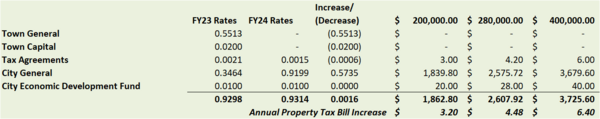

Property owners have questioned the City’s projected $1/year increase on a tax bill for a property valued at $280,000 after noticing that their bills increased more than projected. When the information was conveyed at the time the tax rate was approved by the Council, the data provided to Council did not include the tax agreement rate in the FY24 figures but was included in the FY23 combined rate figures, therefore incorrectly representing the estimated $1/year increase on a $280,000 property.A corrected comparison to include all rates for both fiscal years is included below with additional samples for other property values. The budget and tax rate calculation files will be corrected to mirror the estimated rate comparisons in each file moving forward.

The Tax Agreement rate represents one tax stabilization agreement the City has in place with Whitcomb Family LLC for a property located on South Street. This is an agreement that was renewed in 2023 for a period of 3 years, with renewal for two subsequent 3-year terms. The agreement allows for the property to essentially be exempt from City taxes (not education taxes) in exchange for “allowing non-motorized recreation that does not conflict with farm operations, such as hiking, dog walking, mountain biking, bird watching, cross country skiing, snowshoeing, sledding, bow hunting, and photography by the residents of Essex Junction for the duration of the agreement.”